In today’s rapidly changing financial world, understanding how Ponzi schemes operate is crucial. As we dive into the truth about Ponzi schemes in 2025, we’ll explore key warning signs and uncover how these deceptive operations continue to evolve. Discover recent case studies and learn about the regulations that govern them. Stay informed to protect yourself in this ever-changing landscape.

Understanding the Basics of Ponzi Schemes

Ponzi schemes are deceptive investment scams, where returns are paid to earlier investors using the capital of newer investors. This creates an illusion of profitability and can appear legitimate for some time, often fueled by persuasive schemers and a lack of transparency. These schemes typically promise high returns with little risk, luring in unwary investors eager for financial gain.

In the context of 2025, evolving technological platforms have allowed these schemes to exploit digital spaces, making them even more pervasive.

Blockchain and Cryptocurrency

are newer vehicles being subtly integrated into Ponzi schemes, giving them a guise of sophistication and innovation. It’s crucial to understand the similarities these schemes have with traditional models, including their reliance on incoming funds rather than legitimate profits.

The Origin of Ponzi Schemes

traces back to Charles Ponzi in the early 20th century. His scheme promised high returns on investments in international reply coupons, but returned money to investors using new investments. Understanding this history provides insight into how the basic Ponzi model functions at its core.

While the methods may evolve, at their heart, Ponzi schemes remain deceitful, focusing on recruitment over actual economic activity or market performance. This is a critical point for investors to assess before committing their resources.

How Ponzi Schemes Operate in 2025

Ponzi schemes continue to evolve, adapting to the economic landscape of 2025. Organizers of these schemes often use innovative techniques to lure investors. Technology plays a significant role, with crypto assets and online trading platforms becoming the new vehicles for deception. Promoters promise high returns with seemingly minimal risk, leveraging social media for wider reach and credibility.

The rise of digital communication allows organizers to quickly disseminate information, making their schemes appear legitimate. This increased access means they can target individuals beyond geographic boundaries, expanding their potential victim pool. Fraudsters may set up complex layers of transactions, using encrypted messaging and virtual meeting spaces, making detection even more challenging for authorities.

In 2025, Ponzi schemes often feature phases of initial trust-building. Organizers will

attract early investors by paying returns using funds from new investors

. This initial success story spreads, inducing more individuals to invest in hopes of achieving similar profits. As more people are persuaded to join, the illusion of stability grows.

Advanced technology also empowers perpetrators to mimic legitimate investment platforms. They create detailed websites, complete with fake testimonials and forged regulatory approvals, complicating efforts to expose their fraudulent activities. Despite their digital sophistication, the underlying principles remain unchanged, preying on the allure of high returns.

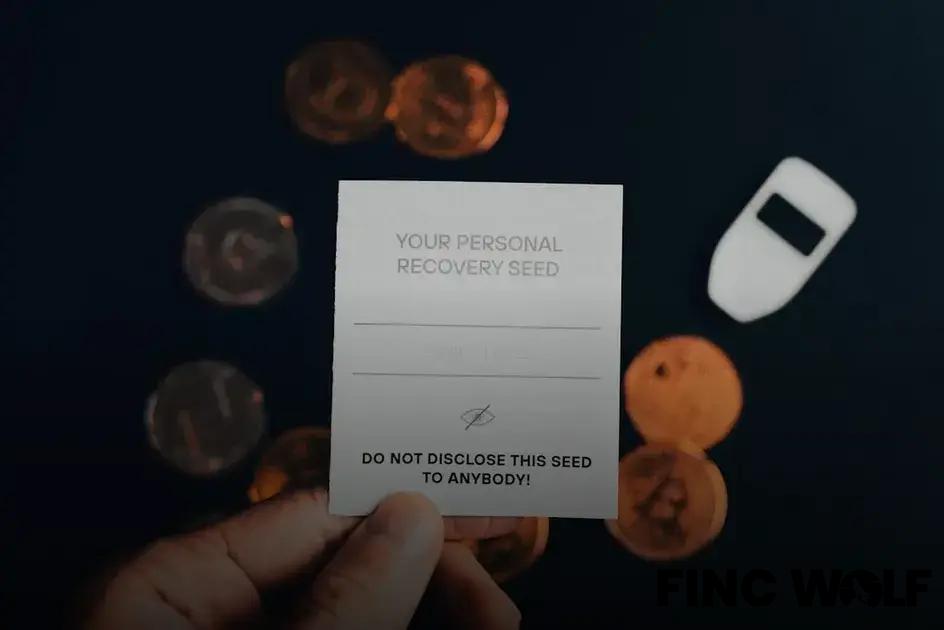

Warning Signs of a Ponzi Scheme

Ponzi schemes rely heavily on attracting new investors to pay returns to earlier ones. One key warning sign is a promise of high returns with little or no risk. If it sounds too good to be true, it probably is. Be wary of investments that offer guaranteed returns.

Difficulties with Withdrawals

Another red flag is trouble when attempting to withdraw your investment. Ponzi schemes usually make it hard to take out money, with various excuses or delays. Lack of Transparency Be cautious if you are not given clear information about how the investment operates. Authentic investments will provide detailed information and documentation.

Unregistered Investments

Ensure the investment is registered with relevant authorities. Most Ponzi schemes are unregistered, preying on uninformed investors. Furthermore, avoid investments that emphasize constant recruitment of new investors rather than legitimate growth strategies. Pressure to Reinvest Promoters often urge participants to reinvest their profits rather than cash out. This keeps the scheme running longer and should raise suspicion. Finally, be attentive to testimonials that seem overly positive or lack specificity. Genuine investments have verifiable success stories and data to back up their claims rather than relying solely on anecdotal evidence.

Case Studies: Recent Ponzi Scandals

Case studies provide valuable insights into how Ponzi schemes are orchestrated, unravel, and impact their victims. In recent years, several high-profile cases have shed light on the evolving tactics of fraudsters. One such case involved a scheme disguised as an investment opportunity in technology startups, promising extraordinary returns. As with traditional Ponzi schemes, early investors were paid with funds from new participants, creating a facade of legitimacy.

Technology and Complexity in Modern Schemes

Recent scandals have highlighted the use of advanced technologies by schemers. They often exploit social media and online communication to reach and convince a larger audience. The complex nature of digital platforms also makes these schemes harder to detect and regulate. Additionally, fraudsters manipulate sophisticated financial jargon to confuse and entice potential investors, disguising their true intentions.

It is crucial to examine these cases closely. By understanding the methodology used by modern fraudsters, regulators and potential investors can be better equipped to identify and avoid falling victim to these scams.

Regulations and Legal Framework in 2025

In the dynamic landscape of 2025, regulations and the legal framework have adapted to tackle the challenges posed by Ponzi schemes. Governments worldwide are tightening their grip on these fraudulent activities. New laws are being enacted to ensure transparency and accountability in financial markets. This includes stricter licensing processes for financial advisors and firms, ensuring they meet rigorous standards.

The introduction of blockchain technology has transformed how financial transactions are monitored, making it harder for scammers to hide their illicit activities. Regulators are embracing technology to trace and identify suspicious transactions in real time. International cooperation has been strengthened, with countries collaborating to close loopholes exploited by cross-border scams.

Central banks are playing a pivotal role, constantly monitoring the market for irregularities. New regulatory bodies have emerged, focusing on investor protection and financial literacy, aiming to educate the public about the hazards of Ponzi schemes. Such measures are invaluable in empowering individuals to recognize and avoid fraudulent investment opportunities.

In 2025, penalties for those convicted of running such schemes have become more severe. Fines are significantly higher, and sentences are longer, reflecting the seriousness with which authorities are treating these crimes. The message is clear: there is no tolerance for financial fraud.

Overall, the intensified regulatory environment in 2025 serves as a robust defense against Ponzi schemes, seeking not just to penalize offenders but also to prevent scams before they start. The legislative upgrades highlight a global commitment to safeguarding investors and maintaining market integrity.

Protect Yourself: Tips to Avoid Scams

It’s crucial to stay vigilant as new scams continue to evolve. Here are some effective tips to protect yourself:

- Research Before Investing: Always verify the legitimacy of any investment opportunity by researching the company and the people behind it. Check for reviews, past performances, and news articles.

- Be Skeptical of High Returns with Little Risk: Be cautious if an investment promises exceptionally high returns with minimal risk. Such promises are often too good to be true.

- Verify Registration and Compliance: Ensure that the investment company is registered with appropriate regulatory bodies. Verify their compliance with legal requirements as protection against possible fraudulent activities.

- Understand the Investment: Make sure you fully understand the investment structure and associated risks before committing your money. Don’t be afraid to ask questions and demand clear explanations.

- Seek Independent Advice: Consult a financial advisor or a third-party professional for an unbiased opinion before making any investment decisions.

- Trust Your Instincts: If something feels off about an investment opportunity, step away and reassess. Trust your instincts and prioritize caution when it comes to finance.

By following these tips, you can significantly reduce the risk of falling victim to a scam.